Regarding the advanced landscape of psychology and economics, Daniel Kahneman can be considered the most outstanding figure. On the one hand, Kahneman is known for his discovery in behavioral economics and cognitive psychology, which is an important contribution to academia, policymaking, and the decision-making process. His Nobel Prize-winning work as well as his numerous books, notably “Thinking, Fast and Slow,” established him as the leading authority in the field of cognitive psychology.

In this study, we have a critical attempt to untangle the mysteries of Daniel Kahneman’s theories and contributions to the field. Firstly, we discuss his history and critical ideas, including his monumental work “Thinking, Fast and Slow” after which we explore the main principles and concepts. The examples, explanations, assessments, and criticisms of his theories guide us as we navigate through these fields. Come with us to discover the genius Kahneman, who revolutionized the concept of our mind and behavior with his work.

Table of Contents

Who Is Daniel Kahneman?

Biography and Background

Kahneman pioneered concepts in behavioral economics and cognitive psychology which are known universally. During his childhood, Kahneman was born on the 5th day of March 1934, in Tel Aviv, Israel.

He began his academic journey at Hebrew University in Jerusalem, where he was awarded his bachelor’s degree in psychology, in the year, 1954. Next, he was offered a Ph.D. in psychology at the University of California, Berkeley, which he was able to complete in 1961.

The initial research triangle by Kahneman was based on the subject matter involving the topics day attention, perception, and judgment. Along with the collaboration with Amos Tversky, a psychologist, they formed a team that had a broad impact on his future writings. The new ideas that resulted from their joint work demolished the challengeous models of economics and paved the road for a new understanding of the human choice-making process.

Why Did Kahneman Win The Nobel Prize?

Kahneman was awarded the 2002 Nobel Prize in Economic Sciences for developing an economic theory that includes insights from psychological research, notably in judgment and decision-making in uncertain situations. Such recognition topped him as the philosopher having a significant impact on psychology and economics.

What Type of Psychologist Is Daniel Kahneman?

Daniel Kahneman, a psychologist has become a one-of-a-kind who whilst dominating behavioral economics and cognitive psychology is most well-known for his work. He often shares the credit for watchwords as heuristics and biases, an essence of the groundbreaking research on the human decision-making mechanisms he conducted.

Daniel Kahneman and Amos Tversky

Kahneman and Tversky in their ecosystem of distinct behavioral biases, cognitive shortfalls, and inherent decision-making errors, have altered how we understand choices and decisions

The work of Daniel Kahneman and Amos Tversky transformed the understanding of human decision-making, by the prospect theory, challenging the fundamentals of economics as described by the classical theory. The work of researchers showed decision-making principles that were shaped by cognitive biases and heuristics, particularly, loss aversion and framing effects.

This was the foundation for behavioral economics and later elucidated into financial planning, marketing, and policy-making. In 1996 Kahneman lost his colleague Tversky but he never stopped the development and popularization of these serious disciplines.

Daniel Kahneman’s Nobel Prize Book

Daniel Kahneman’s Nobel Memorial Prize in Economic Sciences, given under his book’s title “Thinking, Fast And Slow” in 2011 has made a breakthrough in psychology and economics studies.

Is Daniel Kahneman Still Alive?

Daniel Kahneman died on March 27, 2024. (age 90 years)

Daniel Kahneman’s Contribution to Psychology

Daniel Kahneman’s Role in Shaping Behavioral Economics

Together with Amos Tversky, Kahneman redefined behavioral economics with his cognitive biases which have been evaluated as the factor of the irrationality of human decision-making activity, at variance with the classic economic theories. The joint work led to the prospect theory building the attention to psychological factors in financial decisions.

With this functioning across various fields such as economics and public policy, this has a great impact. Kahneman’s book “Thinking, Fast and Slow” opened the gate for behavioral economics to the general public, thus solidifying its founder Kahneman as the key figure in the field.

Kahneman’s Contributions to Cognitive Psychology

Kahneman’s contributions to cognitive psychology have been the major authorities in the area of human thought processes research, that have given us many answers to the questions of how human thinking works. His insights on the differentiation of quick, automatic thinking (System 1) and long thought, deliberate thinking (System 2) have become ever-green even when his awesome book; “Thinking, Fast and Slow” was published.

How Daniel Kahneman’s Work Influences Decision Making

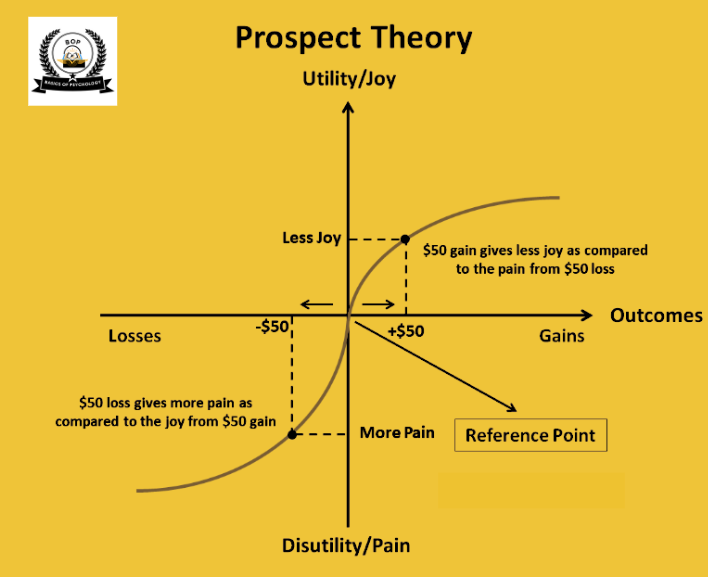

With a special focus on prospect theory, in which individuals evaluate how to deal with the loss and gain case when they are making decisions under uncertain conditions, it was one of the most prominent contributions of Kahneman. This theory challenging the classical economic framework of utility maximization introduces the concept of loss aversion – people for the most part disvalue possible losses of equal size relatively more than comparable gains.

Best Books By Daniel Kahneman on Decision-Making

Here are some of the best books by Kahneman on decision-making:

- “Thinking, Fast and Slow” (2011)

- “Judgment Under Uncertainty: Heuristics and Biases” (1982)

- “Choices, Values, and Frames” (2000)

Daniel Kahneman’s Prospect Theory

The prospect theory, the keynote contribution of Kahneman to behavioral economics, features a rejected view concerning deciding under uncertainty in the traditional economic theory.

It refers to the pair of scientists’ creations that state that people do not always reason with the use of normal calculations of expected utility. Rather they appraise all the possible merits and demerits, they compare the likely gains and losses against their reference point with consideration to their emotions e.g. loss aversion and risk aversion.

What Are The Key Principles of Prospect Theory?

Key Principles of Prospect Theory are discussed in the table below:

| Value Function | The concept that people evaluate gains and losses in a manner dependent on whether the value is positive or negative, with the perception of gains and loss approaching insensitivity as the value increases or decreases. |

| Loss Aversion | A person tends to overemphasize losses more than equal quota of profit, and this may cause the apprehension of the prospect or the potential danger of loss. |

| Probability Weighting | People tend to treat chances as other numbers in their calculations, distorting probabilities even without knowing it when making decisions under uncertainty, for example, over/underweighting smaller/bigger probabilities. |

| Framing Effects | Presenting the information (or framing) in a certain way can simply but profoundly, be able to affect decision-making decisions in such a way that the outcomes at the end can almost look the same but be polarized due to the way the information was presented. |

Kahneman Thinking Fast and Slow

What Is The Thinking Fast and Slow Theory?

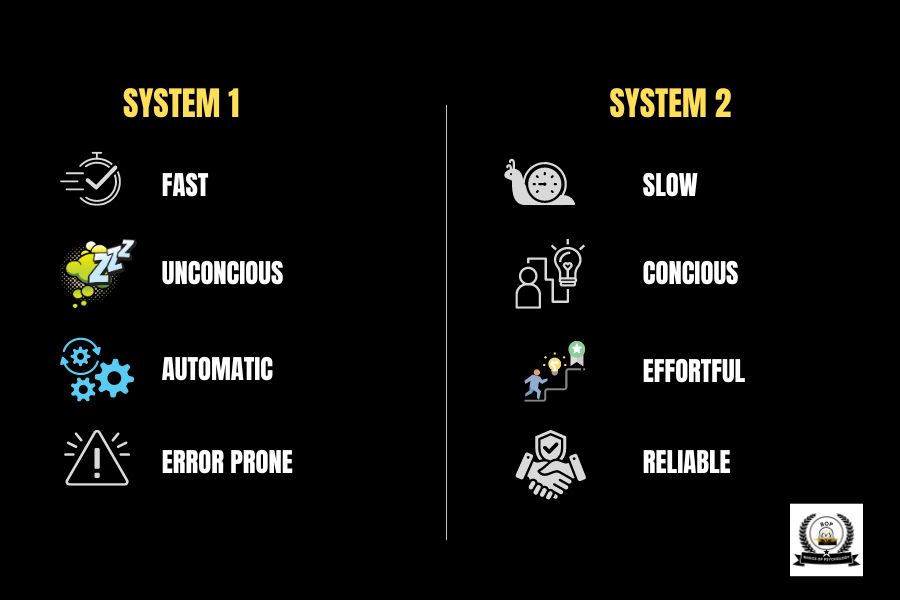

The central thesis of “Thinking, Fast and Slow theory” is that human cognition operates through two distinct systems: System 1 and System 2 thinking. System 1 is quick, instinctive, and erroneous; and System 2, is slow, deliberate, and logical. Kahneman demonstrates how the two systems cooperate and work to move us to reach final decisions, perceptions, and judgments in a variety of circumstances.

System 1 vs System 2 Thinking

The classification of fast and slow thinking – in System 1 and System 2, respectively – is of paramount importance in decoding the ways of processing information and making decisions. Although System 1 works well when it “automatizes” quick decisions, it is vulnerable to biases and heuristics.

On the contrary, System 2 enables the individual to reason deductively, which requires less conscious effort and is less likely to get fatigued but if utilized without proper control and faculties often results in catastrophic decisions.

Can You Be Smart But Think Slowly?

Indeed, it is still possible to be smart intellectually even if one is a bit slow in processing. Some people possess advanced cognitive capabilities but still they rely on System 2 thinking, as a result, they become slow in applying their information-processing skills in certain scenarios.

Hence, intelligence does not account for speed in intellectual processing; rather, critical cognitive components such as cognitive style, task complexity, and environmental conditions also contribute.

System 1 Thinking Example

An instant thinking type is a reaction immediately given when for example a loud sound occurs. The moment you hear a loud bang, System 1 inside your brain, the fast and automatically receptive control system startles and jumps according to Kahneman’s dual-process theory takes into account. Subsequently, it requires effort or clear thought before action.

System 2 Thinking Eample

People, during challenging puzzles or knowledge of the pros and cons of various career paths, solve a hard math problem and carefully consider many different options will precede slow thinking to help them to have good work weighing information, anticipating outcomes, and making informed decisions.

Is Thinking, Fast, and Slow True?

Daniel Kahneman book thinking fast and slow is based on the research that has been done in the field of cognitive psychology and behavioral economics and is thus grounded in empirical evidence. Kahneman, a Nobel laureate in Economics and one of the world’s eminent researchers on human decision-making, provides a clear and in-depth explanation of human decision-making processes, which are based on the results of numerous experiments and observations for decades.

What Are The Benefits of Thinking, Fast and Slow?

Thinking, Fast and Slow” offers several benefits:

| Decision-Making Insight | Grasp the knowledge in the ability to make better choices. From learners to educators, our society will benefit by embracing technology’s powerful impact on education. |

| Enhanced Critical Thinking | Practice these skills that help override prejudices. |

| Improved Problem-Solving | The life skill it focuses on is the art of problem-solving |

| Better Communication | Let messages be specific. |

| Wide Application | Covering business, education, healthcare, and other themes. |

Thinking, Fast and Slow By Daniel Kahneman (30-Minute Expert Summary)

Here’s a 30-minute expert summary:

- Introduction to the Two Systems: Kahneman explicates the notion of the two ways of thinking: System one and System two thinking.

- System 1: System one aims at instinctive and uses heuristics / mental shortcuts. System 1 decision making is fast and efficient but give room for problems.

- System 2: While the System 2 process in general is slower as compared to System 1, it is analytical and deliberate in nature. Critical thinking and problem-solving ability have always been its key features while at the same time providing logical reasoning as well.

- Biases and Heuristics: Kahnemann mentions different cognitive biases and heuristics that manipulate our decision making, for example, availability heuristic-with which an event’s likelihood is judged based on how easy you can call it to your mind, and the anchoring effect which the first piece of information is considered a lot more important in comparison to others.

- Prospect Theory: Kahneman, together with a co-author Amos Tversky, developed prospect theory which describes the way people make decisions under risk. Inspired by the theory of the prospect, the people will evaluate the losses and gains comparing them to an anchor (a reference point) rather than taking them in an absolute way.

- Overconfidence and Planning Fallacy: Kahneman emphasizes the overconfident behavior of people when they are about to make their decisions and predictions, which in turn, they do not even realize the risks and overestimate their skills. The planning fallacy is the propensity to doom oneself to underestimating the task time frame, despite having encountered such instances in the past where the actual duration exceeded the initial expectation.

- Happiness and Well-Being: Kahneman posits the duality in the being of the experiencing self and the remembering self. The real self of this person for the moment is, while the mental self is rebuilding memories towards the summary of the event.

Thinking Fast and Slow Quotes

Here are some quotes from the book “Thinking, fast and slow” :

- “The mind is a machine for jumping to conclusions.”

- “The illusion that we understand the past fosters overconfidence in our ability to predict the future.”

- “The world makes much less sense than you think. The coherence comes mostly from the way your mind works.”

- “Nothing in life is as important as you think it is, while you are thinking about it.”

Daniel Kahneman Quotes

Here are some quotes by Kahneman:

- “We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.”

- “The confidence people have in their beliefs is not a measure of the quality of evidence but of the coherence of the story the mind has managed to construct.”

- “Intuition is thinking that you know without knowing why you do.”

- “Success = talent + luck; great success = a little more talent + a lot of luck.”

Legacy and Influence

Influence on Future Research and Scholars

Kahneman’s research has also spurred new lines of research, through which many scholars are endeavoring to checkmate and confirm his theoretical foundation and empirical findings.

Exploring neural substrates of cognitive biases and modeling the decision-making of computers are just a couple of examples of the types of research that are actively being engaged by researchers who are extending and updating Kahneman’s principles in different settings.

Contributions to Political and Social Discourse

Kahneman is known not only to have greatly influenced academia, but he also has his intellectual input spread throughout political and social contexts that support discussions on risk perception, behavioral ethics, and the role of government intervention in the context of individual behavior.

His widely known books such as “Thinking, Fast and Slow”, have been simplifying the complex psychology ideas for the average psychology readers, therefore people began to be more aware of the determinants affecting their decisions.

Conclusion

Psychology, economics, and decision science have changed a great deal ever since Kahneman has completed his work of lifelong and Kahneman’s works had a huge contribution to all the fields. Over his professional life, he has been the founder and the primary strategist of the field of behavioral science due to his groundbreaking work and accessible writing that has dramatically transformed the wind of human thinking and decision-making, questioning the previously given wisdom and providing the previously lacking understanding. And even though it has become even harder for us now to rationalize an overly unpredictable world, Kahneman’s wisdom stays with us, showing flawed human beings how vulnerable our minds can be.

Kahneman, an economist and psychologist from Princeton, won the Nobel Prize in 2002 for his concepts in behavioral economics and cognitive psychology. Along with his theories such as prospect theory and “Thinking, Fast and Slow”, he set a benchmark for our current perception and operation of human decision-making. Although his studies aroused some doubts, Kahneman’s reputation founded many of the strategies that are implemented by researchers, policy-makers around the world, and the public.

Not only will the work of Kahneman, in the future, remain a fountainhead of inspiration and innovation in psychology, economics, and also other sciences, but it will look to the legacy of Kahneman forever. Through the continuation of his path in refining these rudimental insights and addressing remaining conundrums, thinkers are destined to highlight the intricate configuration of human cognition and behaviors eventually leading to the society improvement.

FAQS

Who is Daniel Kahneman?

Kahneman is a Nobel laureate psychologist whose contributions to behavioral economics and cognitive psychology have placed him in the limelight, including his investigations on making choices and how these decisions fail to comply with cognitive biases.

What are some key contributions of Daniel Kahneman?

Kahneman’s importance lies in his creation of prospect theory, a concept disrupting the then-current understanding of decision-making when uncertain, and his study on cognitive biases like chance heuristic and anchoring effect.

How did Daniel Kahneman’s work influence behavioral economics?

Kahneman and Ams Tverskis’s works constituted the area of behavioral economics by challenging the essential of rationality as assumed in traditional economics and by highlighting the biases of behavioral decision-making.

What is “Thinking, Fast and Slow” about?

The book “Thinking, Fast and Slow” is a compendium of Kahneman’s research that explicates the operating principles of two thinking systems and their consequences on various types of judgments and choices.

How has Kahneman’s work impacted practical applications?

Kahneman’s findings compel all other disciplines such as finance, public administration, and marketing by rendering behavioral insights, leading decision-makers design of a particular intervention, and the way to structure organizations’ processes.